Whilst the market has sold off in the expectation of FED tapering in the face of an improving economy, and co-incident economic data continues to show improvement, the leading data is likely to do otherwise in the coming months. This means that after an initial improvement of short duration the pressure will again be back on the co-incident data, and hence the FED. Whilst the stock market could have many reasons to be selling off in the near future, fears of FED tapering should not be amongst them.

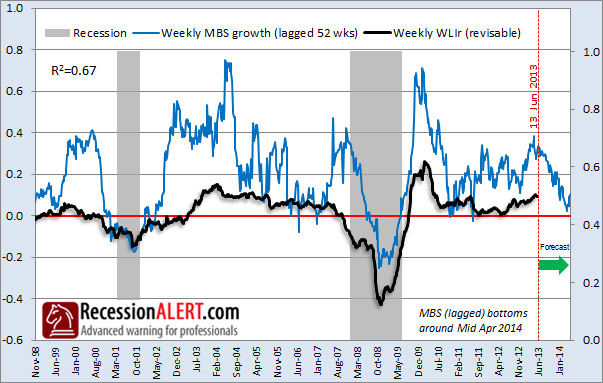

A few weeks back we started warning our clients of a roll-over of the leading weekly data based on the correlation of weekly MBS and our Weekly Leading Index WLIr. There is a better than two-thirds long-term correlation between WLIr and MBS pushed forward 52 weeks and as the chart below shows, we have multi-month downward gravitational forces on the weekly leading data until April 2014. One could even make the assumption that recession risk is likely to peak again around this date.

(Hear more: Dwaine Van Vuuren: No Recession in Sight for the US)

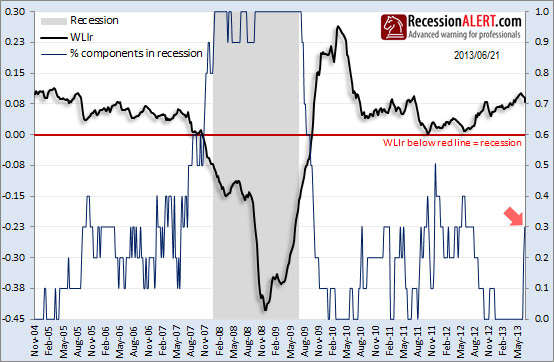

The WLIr is a weekly leading index composed entirely of more than 50 weekly leading time series grouped into 5 composites representing the stock market, credit spreads, corporate bonds, employment and T-bill spreads. It is published weekly on Thursdays and today’s update appears below: