As e-commerce continues to grow at a rapid pace – and Amazon looks to gobble up the world – Goldman Sachs asks the question: what type of products and services cannot be sold online? From an investing perspective, identifying companies relatively immune to online competition has been fruitful, as they have outperformed their general stock sectors.

E-commerce and online channels pose an Amazon-like threat but certain business are immune

Regulation Can Protect Firms From E-Commerce Competition

In general, there are four themes protecting a business model from online competition.

Regulation can be a primary protector for a business model. The need for physical interactions at a pharmacy, for instance, keeps online-only firms from entering unless, like the Amazon purchase of Whole Foods, the online player can purchase or build a physical presence.

In addition to many prescription medicines requiring a doctor’s visit, Goldman notes that certain medical equipment, such as eyewear, requires a physical interaction.

“As patients need to get their eyes tested in person before purchasing glasses online, the absence of the convenience factor makes online commerce less compelling,” the report said. Even these barriers are starting to fade to various degrees, with French-based Essilor developing an eye examination process online.

Healthcare aside, there are few regulatory barriers to online purchases, with car purchases required in local dealerships, as is the case in New Jersey, being examples where regulations restrict online purchases. Left unmentioned were certain financial services transactions that have a regulatory cover that is preventing online adoption, including Citadel’s attempts to break into the relationship-driven dealer bond market, as one example. Some of these barriers might eventually break down, however.

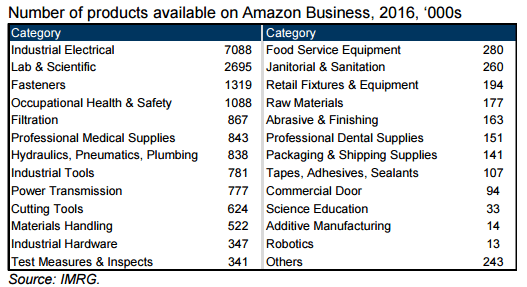

Amazon is expanding into business to business

Distribution Complexity Protects Firms From E-Commerce

Distribution complexity is also a challenge for budding e-commerce companies, with many business to business transactions falling into this realm.

In many cases it is not good enough to be just cheaper than traditional competition – often times there needs to be a significant cost differential to encourage a change in buying patterns, particularly in B2B transactions.

Because business warehousing and distribution already have much of the cost taken out of the system – they don’t have high-priced retail stores, for example – this makes the cost incentive to bring B2B transactions through an e-commerce loop less cost effective.

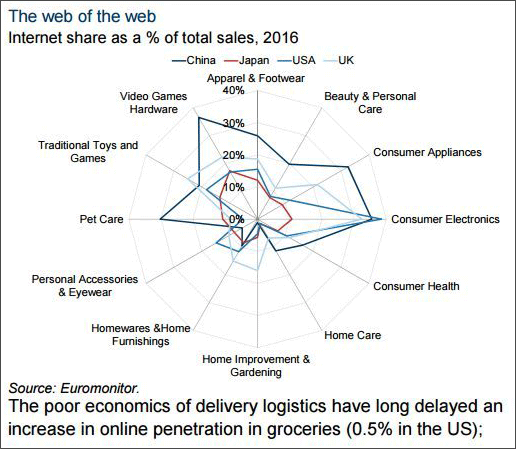

Noting the distribution challenges posed for grocery delivery, Goldman nonetheless calls this “the largest untapped opportunity within consumer retail." The perishable nature of the product makes the distribution channel significantly complex. Solving this dilemma might require a change in consumer habits:

One solution could be encouraging customers to shift to predictable, replenishment driven purchases: for example, a scheduled, monthly delivery of basic essentials like toothpaste, rice, razors, toilet rolls and juice, along with a loaf of bread or a box of detergent makes it a more feasible proposition. The likes of Unilever focusing on direct-to-consumer sales (with the acquisition of Dollar Shave Club) means that this is not an inconceivable scenario.

Physical Experience Protects Firms From E-Commerce

Any business where a physical experience is paramount to the sale – such as an amusement park, one of the more obvious examples – is likely to be immune from online competition. Other examples include cruise lines, concerts, and gymnasiums.

Amusement parks, in particular, look attractive. With average ticket prices rising 15% over the last three years, far outpacing inflation, this discretionary spend has also witnessed strong user growth.

“The core physical experience has to remain irreducibly human,” the report noted.

In addition, businesses that aid in consumption – recommendation/consultation, product expertise, customization, and installation – are difficult to reproduce. Likewise, personalization of a product or service is defensible to various degrees. High ticket purchases that involve life adjustments, such as a home or home furnishings, are often bought in the physical world as well.

The fourth theme that holds back online competition is the need for immediacy. There are certain products people want them when they want them, and the corner drug store is the easiest and least expensive mode of attaining them. While Amazon is currently offering one-hour delivery, the cost and efficiency of offering low-cost products in such a fashion remain a long-term question mark.

By Mark Melin