Russia, Saudi Arabia, and the US will feel the effects of oil prices in radically different ways.

It would be logical to think that the emergence of ISIL would have increased oil prices, but Brent crude oil prices have plummeted since July. Having now traded as low as $83 per barrel, oil is at its lowest price since 2012. The steep decline can be attributed to three trends: surging supply led by US fracking production, stagnating European demand, and a strengthening dollar.

Declining prices could have a negative impact on oil-producing economies around the world, but some have significantly more risk than others. There is no silver lining for an already weak Russian economy, while the US stands to benefit from its strengthening currency. Saudi Arabia’s fate remains largely in its own hands, depending on how much influence it can exert on other OPEC members.

Russia

Of all the major trends driving oil prices to two-year lows – dwindling European demand, a glut of global supply, and a strengthening dollar – not one bodes well for Russia’s economy. These negative effects are only compounding the miserable year Russia is already having, between sanctions from the US and Europe and rapid capital flight. The World Bank projects Russia to only grow 0.5% this year, which at this point may be optimistic.

As a result, the ruble has fallen to historic lows against the dollar and euro. To prevent further depreciation the Central Bank of Russia is spending billions – up to $3.2 billion a week – to prop up its currency. As the ruble becomes weaker, Russian consumers’ buying power of foreign goods will deteriorate. This leaves Russia facing a perfect storm of sanctions, decreased import revenue from oil, and decreased buying power of its remaining income.

[See: Unleashing the Oil Weapon Against Russia: How to Destroy a Great Empire]

To add to the grim outlook, 79% of Russia’s oil is exported to Europe, with the remaining bound for China. Europe’s economic activity, which is highly correlated with its oil consumption, has stalled even in previously healthy countries such as Germany. If Russia is to return to growth, it will have to find buyers for its oil and gas outside of Europe.

Falling oil revenue will put pressure directly on the Kremlin’s finances. Half of Russia’s government revenue comes from oil and gas. Swings in the price will determine whether Russia will have a deficit in 2015. With sanctions cutting Russia off from many of the largest long-term debt markets, financing the deficit will be difficult. Russia’s budget falls into deficit at oil prices between $100 and $110 per barrel.

United States

The outlook for the US is much better than for Russia. In large part, this is due to the end of quantitative easing and that oil across the globe is traded in dollars. The Federal Reserve is beginning to tighten monetary policy, although it is still far from raising rates, at the time Europe and Japan are loosening. As a result, the Dollar Index has risen 21% since July. Since oil is traded in dollars the world over, the US is not exposed to exchange rate risk like Russia is.

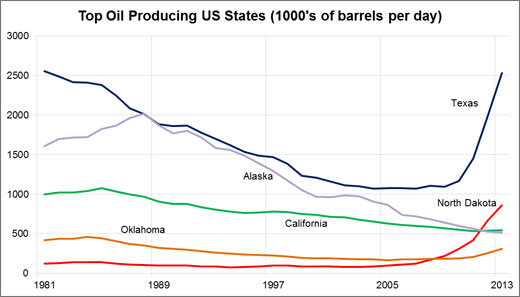

Further, the price of oil will naturally fall with a stronger dollar. Around 10% of the fall in Brent crude prices since July are likely due to the rallying dollar. Much of the rest of the fall has been precipitated by the fracking boom in North Dakota and Texas.

Data source: Energy Information Administration

The rise of fracking (especially in North Dakota, which produced very little oil before 2005) has changed the domain of US energy policy. Energy independence may still be a longshot, but much more realistic than it was ten years ago. The wealth and jobs flowing to North Dakota has also been a game changer: unemployment during the peak of the recession was just 4.2% and currently sits at national low of 2.8%. The average apartment in Williston, ND, now rents for more than in Manhattan.

The irony of the fracking boom is that it may ultimately cause its own end. For a fracking project to be profitable, the price of oil must be higher than traditional oil projects. The full-cycle breakeven price is about per barrel, which it has been since 2010. Given that many players in Texas and North Dakota have already started to set up new wells, the breakeven price now may be closer to . That has led to the acceleration of US production, and ultimately to a record excess stockpile. If the current trend of supply outpacing demand continues, the fracking boom may end itself.

Saudi Arabia

Another emerging risk for the US fracking boom is a price war waged by Saudi Arabia and OPEC. As the largest producer in OPEC, Saudi Arabia has an incentive to throttle oil supply to maximize its own profits. Its costs of production are also much lower than fracking producers. If Saudi Arabia’s oil leaders have the wherewithal, they may be able to produce enough oil in the short-term to push many US producers out of the market for the medium-term.

[Read: Saudi Arabia Still Calling the Shots]

As FT Alphaville notes, however, this is complicated by the Saudi’s lack of ability to control the production of Algeria, Angola, Libya, and Nigeria. Faced with the problem of falling prices and exploding US production, a complete reworking of OPEC production guidelines – and the nasty negotiations that would go with it – may now become a pressing issue. This would be the only way to guarantee that Saudi Arabia could coordinate the cartel to its benefit — and the fracking boom’s detriment.