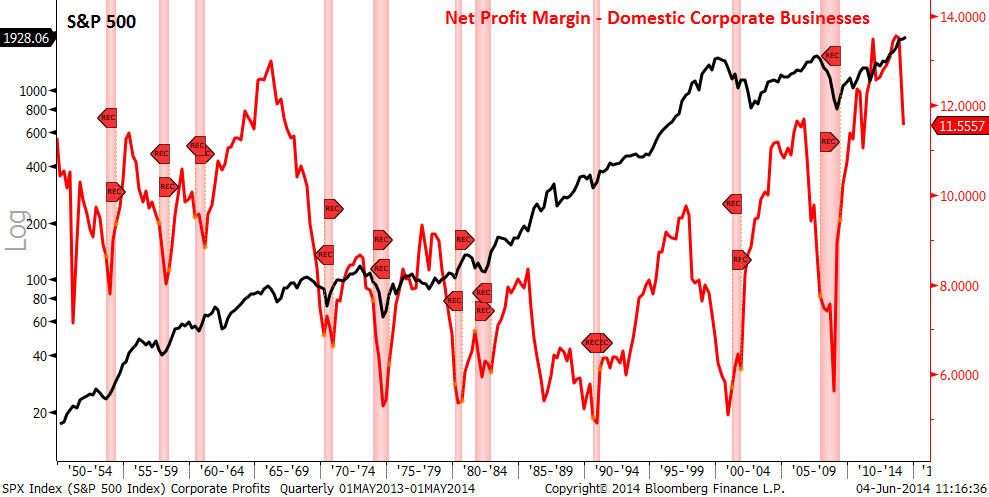

A number of well-respected market commentators have recently pointed out that corporate profits appear to be reversing. This is an important development since corporate profits typically peak before bear markets and economic recessions, as highlighted in a previous post (Corporate Profits and Market Crashes) with the following chart, which has now been updated to show the recent downtrend:

With corporate profits now trending lower (as measured by the US Bureau of Economic Analysis (BEA)), does that mean a bear market and economic recession are right around the corner? Given the data above, the best way to answer this question is by simply looking back and measuring how long it typically takes before corporate profits peak and trouble occurs.

If you do this for the 60 years of data and 8 complete business cycles shown in the chart above, you’ll find that BEA’s measure of corporate profits peak on average over a year before the stock market peaks and over two years before the onset of an economic recession.

If we neglect the average and look at the shortest and longest delay instead, then stocks could be peaking right now, as occurred in the early 70s, or could peak in another 4 to 5 years, as occurred in the mid-80s cycle. So, although corporate profits serve as a great leading indicator, it’s the specific lead time that’s questionable, which means that it doesn’t serve as a great timing tool for when exactly the stock market is going to peak or the economy is about to head into recession.

For that you need to look at another measure of corporate profits—real-time reporting of all S&P 500 companies (shown below)—for further confirmation.

As you can see, the 12-month trailing profit margin of all S&P 500 companies serves as a much better coincident timing indicator of market peaks and, as well, a more imminent red-flag of economic recessions.

Obviously, no one indicator should be used for making investment decisions or for attempting to “time the market.” Now that BEA’s measure of corporate profits has appeared to reverse trend, there is a heightened risk we are entering the latter stages of a business cycle. However, since the market can often surprise investors and push much higher before finally peaking (even years after leading indicators roll over), it is always important to monitor major trend changes in economic data, credit spreads, internal market metrics, and, as highlighted above, real-time S&P 500 profit margin data for confirmation.

Stay tuned as we monitor these and other important market metrics moving forward.