Perhaps one of the most influential books I’ve read over the last several years is “The Era of Uncertainty”, which was co-authored by Francois Trahan—voted as the #1 Portfolio Strategist in 2013 by Institutional Investor. In the book, Francois shows how the Fed Funds Rate no longer serves as the key variable driving swings in the market and economy. Instead, he argues, in a world of nearly zero interest rates, "Inflation is the new fed funds rate."

Why does this matter? Well, in the past, the Fed raised short-term interest rates to cool the economy and often a recession would ensue, while it lowered them to stimulate the economy back towards growth. However, with the Fed currently committed to keeping rates near zero, changes in the rate of inflation have now become the key variable acting on the business cycle. Like rising interest rates, rising inflation is a bearish force that eats into discretionary spending and corporate profit margins while falling inflation puts money back into consumers' pocket books, boosts corporate profit margins, and helps to stimulate economic growth.

With that in mind, monitoring real-time and lagging inflation indicators is helpful for investors trying to identify or avoid heightened risks of a correction. This was a point I stressed when calling for an intermediate market top and correction in February 2012 (see Countdown to Market Peak Has Begun) based on rising inflationary trends at that time. (Note: the S&P 500 peaked in early April at 1422.38 and then underwent an 11% correction before bottoming at 1266.74 in early June.)

As I warned then and show in this report as well, various indicators suggest that inflationary pressures are again starting to build and will likely exhibit their influence on the economy later in the year (in this case around the fall). The countdown to another market peak has likely begun.

Inflationary Trends on the Rise

We received May’s Consumer Price Index (CPI) data which showed the largest monthly increase in headline inflation since 2011 with the index up 0.35% over last month. May’s increase marks the third consecutive acceleration in the headline and core inflation data.

This trend carries a bearish message as changes in inflation typically lead turns in the economy by roughly six months. Given inflation bottomed in February, this suggests economic weakness could begin to surface as early as August. The link between inflation trends and economic activity is shown below in which the NFIB Small Business Higher Prices index is shown advanced by six months and inverted for directional similarity with the ISM Manufacturing PMI below. With the rise in the NFIB price index to the highest level in three years, we are likely to see the ISM PMI peak in the next couple of months and then decline in the fall.

Indirectly, we also see an additional confirmation for the above coming from the relative performance of the consumer discretionary and energy sectors. The consumer is weakened by stronger inflationary trends while energy companies benefit, and so the relative performance between the two is closely tied to inflationary trends. Given the inflation link in the two sectors' relative performance and Trahan’s thesis that inflation trends lead the economy, relative sector performance of the two sectors has shown a decent track record of predicting growth swings in the economy as measured by the ISM PMI index. The recent outperformance by the energy sector relative to the consumer discretionary sector suggests, like the NFIB Higher Prices Index, that the manufacturing sector of the economy should stall in the next few months and then decline heading into the fall.

As outlined above, inflationary trends tend to lead economic growth and since the stock market is closely linked to changes in the economy it then follows that inflationary trends influence stock market returns. The link between inflationary trends and the S&P 500’s year-over-year (YOY) rate of change is shown below with the annual growth in the CPI shown advanced and inverted for directional similarity. The recent upswing in inflation we’ve been having suggests the growth in the stock market peaks in the months ahead and then declines heading into the fall.

Do Not Mistake a Growth Recession for a Full Blown Recession

While I am calling for economic and stock market weakness in the fall, the bigger picture view of the economy still remains solid. Essentially, I am calling for a growth recession (a decline in the economic growth rate) but not an outright recession, which sees negative growth. While inflationary pressures have been building this year, so too has the momentum in employment. The three month moving average of monthly payroll changes is currently 234K, the strongest growth rate since early 2012. The economy’s 12-month average of 217K jobs added a month is only 22K a month shy of hitting a 14-year high.

Not only has the growth in monthly payrolls increased, but so too has the breadth of that growth as roughly 70% of industries are adding to their payrolls, higher than the best levels seen during the 2001-2007 economic expansion.

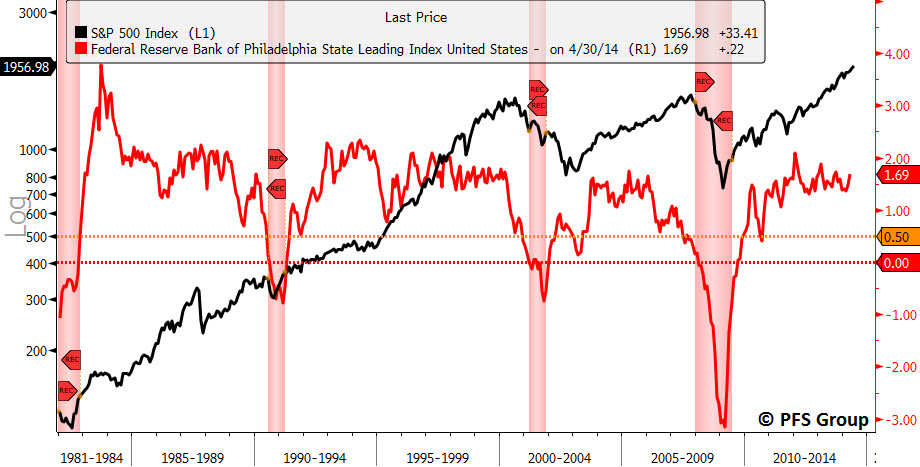

Outside of payrolls, various leading economic indicators (LEIs) are also not flashing any warning signs to suggest a recession is on our horizon. The Philly Fed’s State LEI for the US is still well above negative territory and comfortably above the warning level of 0.50% (orange line).

Summary

With the advent of the Fed’s zero interest rate policy (ZIRP) that began in 2008, short-term interest rates can’t account for the economic swings we’ve had since 2009. As Francois Trahan eloquently argued in his book, “The Era of Uncertainty,” following inflation trends can help investors get an early read on future economic growth and, thus, the stock market. We’ve clearly seen a pickup in direct and indirect measures of inflation recently, which suggests economic growth and the stock market may stall in the months ahead before declining in the fall. While we could be setting up for our first 10%+ correction in some time, by no means am I calling for a bear market or recession, but rather a growth recession similar to what we saw midyear for 2010, 2011, and 2012. Current employment momentum and breadth in addition to various LEIs argues against making a recession call. Rather, the warning provided in this article suggests to shift one from focusing on return to focusing on risk management as we head into the fall and to look for a good buying opportunity should a correction occur.