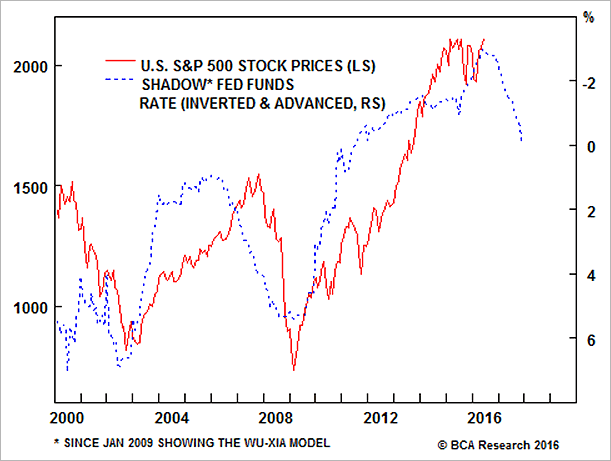

Investor optimism has been rekindled as weakening US employment has deferred Fed interest rate hike expectations. Nevertheless, the Fed may stay hawkish because the labor market is near full employment, unemployment insurance claims remain below 300K, core inflation is firming and wage inflation is trending higher. Monetary conditions have been tightening ever since the Fed completed its bond purchases in October 2014. Using the Wu-Xia shadow Fed funds rate, it is obvious that a less accommodative Fed at the margin has let the volatility genie out of the bottle and, more importantly, capped equity market returns. Thus, the risk remains that the Fed raises rates and rekindles the loop of a higher US dollar leading to tighter global financial conditions, in turn causing a stock market correction, and forcing the Fed to back off its hawkish rhetoric.

See The Single Most Important Chart to Understand Where We Are Today

Bottom Line: While a run toward all-time highs is possible leading up to the next Fed hike, the risk/reward tradeoff remains to the downside and our Global Alpha Sector Strategy service cautions investors not to chase equities higher from currently extended valuation levels.

For additional information, please visit our Global Alpha Sector Strategy website at gss.bcaresearch.com.