- Vice Spending: Some air is leaking out of the tires

- Deceleration indicated for 3Q

Vice Spending: There’s a Leak in the Tires

For most American households, everything is fine.

But for more and more households, things are not so good. The industrial sector’s recession has spread and it’s getting more impactful. That’s one leak.

Hear Davidowitz: We Are Seeing 'Massive' Store Closings Across the US Right Now

Another is that income growth is slowing. Unlike the credit bubble days when people leveraged up, American households now tend to spend within their means. Retail spending growth tracks income growth. Plus, Private Industry Employee Compensation growth is slowing. It’s still positive, but slower.

The impact just showed up in slower vice spending, which sagged this month. That’s bad for the 3Q broader consumer spending because vice spending is the ‘canary in the coal mine.’

For the most part, summer spending is relatively safe, particularly vacations. It’s May and as such, plane tickets and hotel bookings have already been purchased. Budgets are already prepared for summertime incidentals. The next key inflection point will be August when vacations end and back-to-school spending begins.

To be clear, this is still a growth story. US growth continues but at a slower pace. Think 1990, not 2008.

Vice Spending Color

- Gambling slows during Easter

- Booze consumption was ‘less bad’

- Escort business looks for growth

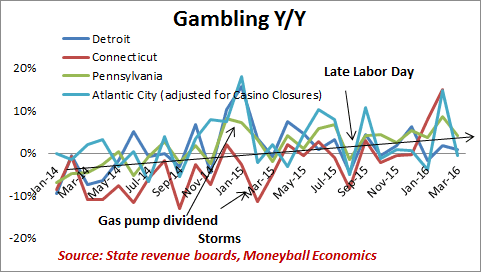

Gambling Slumps on Easter

Unlike secular holidays like Independence Day, religious holidays like Easter are bad for gambling. This year Easter fell on March 25th versus April 3rd in the prior year. It makes for a weak year over year comparison. And yet… there is still growth.

The implication here is that this momentum carried forward into April.

Casinos report mild US growth:

- Caesar’s (Nasdaq: CZR) reported a 4% rise in revenues.

- MGM’s (NYSE: MGM) US revenues rose 3%.

- Boyd Gaming (NYSE: BYD) is up 0.4%

- Scientific Games (SGMS) reported a 4% rise in revenues for 1Q 2016. (SGMS operates in gaming and lotteries.) It was higher in the US.

All of this is steady but not impressive. MGM revenues are way down from the double-digit growth of 2014.

The takeaway is that the US consumer continues to spend but growth is slowing. This is very much consistent with a slowdown in income growth.

Restaurant Sales Reverse and Head Down

In a bad sign for April’s retail spending, restaurant sales expectations fell back in March. It’s still growing, but the pace continues to slow.

That’s troubling. March included Easter, a major holiday for the food services industry.

According to the National Retail Federation, of the .3B Americans are estimated to spend during Easter, the biggest category is dining (.5B). But spending was more of a miss than a hit. Heading into March, expectations rose only to fall again (per the National Restaurant Association). That was confirmed by the Census Bureau’s March Retail Sales data for food services: spending fell (-0.8%) month over month.

It’s the same story – consumer spending remains solid but it isn’t growing much. Vice Index data, gambling and now dining out… the growth momentum is leaking out.

The implication for April retail is also problematic. At the current level of Restaurant Sales Expectations, food services could pull back in April. That’s what happened in January when the sales expectations were this low: Retail (ex-autos and gas) slipped -0.5% m/m.

Hookernomics: The Escort Business Looks for Growth

In the business of monkey business, economic stress tends to manifest in certain basic ways.

- Greater Supply: Retired providers may return, or more visiting escorts may appear (the classic marketing angle of limited time availability which creates demand).

- Lower Prices

- Extra Services or Freebies: Longer hours, additional services, etc.

At this time, none of the signs of stress are evident. Turned around, because the escort business isn’t stressing, neither is the broader economy.

At the same time, slower economic growth is evident in service differentiation. Think of it in terms of McDonald’s (NYSE: MCD) successful campaign of Breakfast All Day and the way it captured business from the competition. Fast food dining has hit a ceiling and McDonald’s wants a bigger share of the no-longer-growing pie. As far as McDonald’s is concerned, nothing has changed: regardless of name and ingredients, it’s still just a meal being sold from its store.

In the world of escorts, an example of recent service differentiation is a faddish offering of cuddling. It is being packaged as a new offering that is priced like an erotic massage but includes cuddling. (Apparently there is customer demand, just as McDonald’s discovered that there is a lot of demand for breakfast in the afternoon.)

Ultimately it’s also just marketing. As far as the escort is concerned, like McDonald’s – regardless of name and offering specifics – a sale is being made with no impact on the underlying time and money calculus. Like McDonald’s, cuddling as a discreet offering has an objective to attract business through packaging and positioning. Like McDonald’s, it’s a sign that organic business growth has stopped and new approaches are needed. If necessity is the mother of invention, then what is the necessity driving this creative marketing? It has to be an economic need. Escorts are responding to the end of economic growth.

Caution Ahead

For the next few months, be very wary of the conventional macroeconomic data points. When economic inflection points are underway, two things happen with the official data.

First, the data gets noisy and contradictory. One group that monitors payrolls may assert a slowdown, while another group that tracks spending may see growth. Worse, mainstream media will always spin the positive in the data.

Read Economist: US Won't Tip Into Recession Until 2019 (If the Fed Doesn't Mess Things Up)

Second, the models miss inflection points. A classic case in point is last year’s 1Q payroll data. The preliminary data was sunshine and roses. Then a few months later the payroll data was revised down – sharply. It went from preliminary 681k jobs added in 1Q 2015 to 556k added in the revisions. That’s wasn’t just a 20% cut in the figures, it was a major shift: from the steady growth of 220k average per month to a much slower 190k.

A more current example of a breakdown in the mainstream data point model happened last week with the retail spending data. All month long retailers and clothing companies have been reporting atrocious sales data. Many reported year-over-year drops in revenue of 5%-10%. But the official retail sales data reported a solid 1.5% y/y jump in clothing sales.

Pure divergence from reality.